For instance, it doesn't charge any transaction fees on more than 1,300 no-load mutual funds. With that said, E*TRADE excels in a ton of other aspects. If you want to trade via debit, you'll have to use the Apple Pay app. Unfortunately, E*TRADE only covers US markets and doesn't accept electronic wallets and credit/debit cards for money transfers, making the gifting process quite a pain. Plus, it has a large mutual fund and investment selection. Alongside the company's $0 commission, it also offers powerful trading platforms (E*TRADE Web and Power E*TRADE) and exemplary educational resources. Uninvested cash is transferred into an account paying 0.01%Į*TRADE is among the most popular online brokers, and it's easy to see why.However, this is not important for kid investors. International versions of Schwab require a minimum deposit of $25,000. Furthermore, you can only trade assets available on Canadian and US exchanges. While this all sounds like the perfect deal, Charles Schwab falls short on sweep rates and charges high fees for mutual funds. In addition, Schwab offers quite a few trading platforms, including StreetSmart Edge, StreetSmart Central, and Schwab Mobile apps.

Individuals with Charles Schwab custodial accounts gain access to over 4,000 non-transaction fee mutual funds with low expense ratios of 0.50% or below. This makes it ideal for both active traders and testing-the-waters investors. Charles Schwab has a $0 account minimum, $0 maintenance fees, and a $0 commission for stock and ETFs (Exchange-Traded Funds (ETFs). Charles Schwab (Now Owns TD Ameritrade)Ĭharles Schwab is ideal for beginner investors and investors in search of no-minimum index funds. For example, we describe the Fidelity Youth Account - an innovative account for teen investors established by Fidelity in 2021.Ĭharles Schwab (Which Now Owns TD Ameritrade)ĭetails of Each Custodial Brokerage Account 1. To help you choose the right custodial brokerage account, here is a list of 10 online brokers that offer the best accounts for your kids! After the list, we give more details below about each company’s specific offerings. In general, we value companies that 1) charge no fees for trading stock, 2) require low to no minimum balance in trading accounts, and, 3) allow investors to buy fractional shares, which means that they can buy a small fraction of expensive stock such at Tesla which is currently over $1,000 per share.

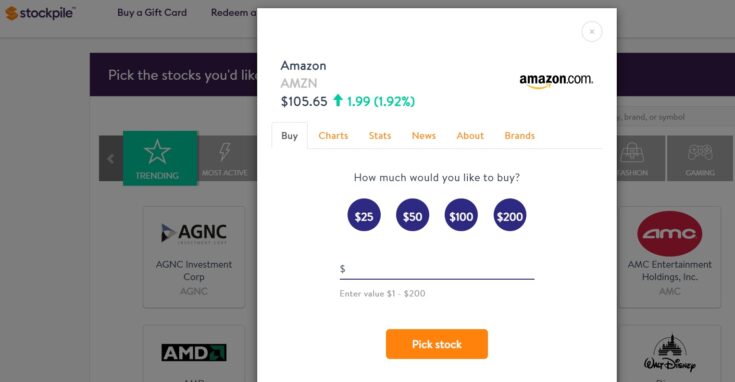

List of the Top 10 Custodial Brokerage Accounts Click on the image below for more information or on the 55-second video below for a summary of the course.

You may also want to consider having them take The TeenVestor Stock Certification Course created specifically for aspiring teen investors.

Stockpile custodial account how to#

Incidentally, many parents use custodial brokerage accounts as a way to teach their kids how to invest in the stock market.

Though you establish and control all investments in the accounts, the assets belong to your kids and they take control of these assets when they turn 18 or 21 (depending on the state in which you reside).įor information on the details of custodial brokerage accounts and how to open them, CLICK HERE. You can use these accounts to teach your kids how to invest in stocks, exchange-traded funds, mutual funds, and other assets. Opening custodial brokerage or investment accounts are among the easiest and smartest ways of giving your kids under the age of 18, the investing training wheels they need to secure a strong financial future.

0 kommentar(er)

0 kommentar(er)